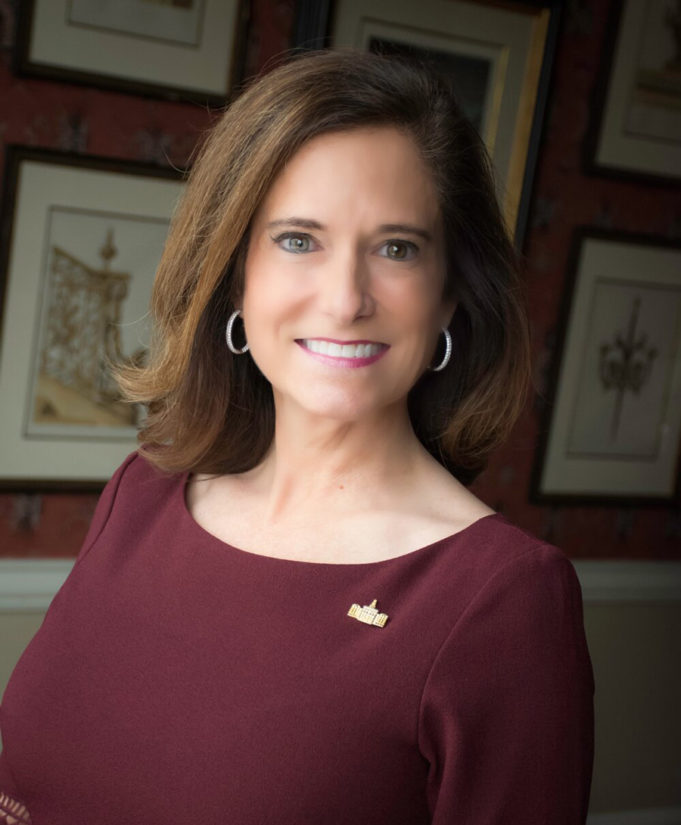

The search for Tarrant County residents who misuse homestead exemptions is indefinitely on hold, and some wonder if the delay is tied to $17,000 in campaign contributions made to Wendy Burgess, Tarrant Appraisal District (TAD) tax assessor.

In December, Burgess and TAD’s five appointed board members agreed on the need to strip deceased homeowners from TAD’s rolls. The children of those dead former residents are unfairly enjoying property tax breaks, said Burgess and the board members through public statements at the time.

The December board meeting soon derailed, though, as Burgess (a nonvoting member of the board) and board member Joe Martinez attempted to bypass TAD’s staff recommendation for the administrative cleanup: Tyler Technologies. Burgess tried and failed to force a vote in favor of Linebarger, the national debt-collecting company that, according to campaign disclosure reports, donated $17,000 to the tax assessor over the past three years (“ Keeping Tabs on TAD,” Jan 6).

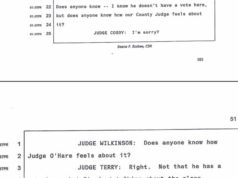

The Tarrant County DA’s office appears to be blocking open records requests seeking communications between Burgess and Linebarger. Asking for a “legal brief” from the state AG, as the DA’s office has done here, is a legal maneuver commonly used to prevent embarrassing or potentially incriminating communications from coming to light.

Board members put the procurement process on indefinite hold at Friday’s board meeting. The campaign contributions to Burgess (and her heavy-handed push for the firm in December) likely muddied the entire process. The delay could mean the loss of millions in tax revenues for TAD and stakeholders like the Fort Worth school district. To add transparency to future vendor reviews, TAD leadership should consider only vendors that do not donate in local elections. Political gifts should never replace a competitive bid that seeks to give Tarrant County taxpayers the best return on investment.