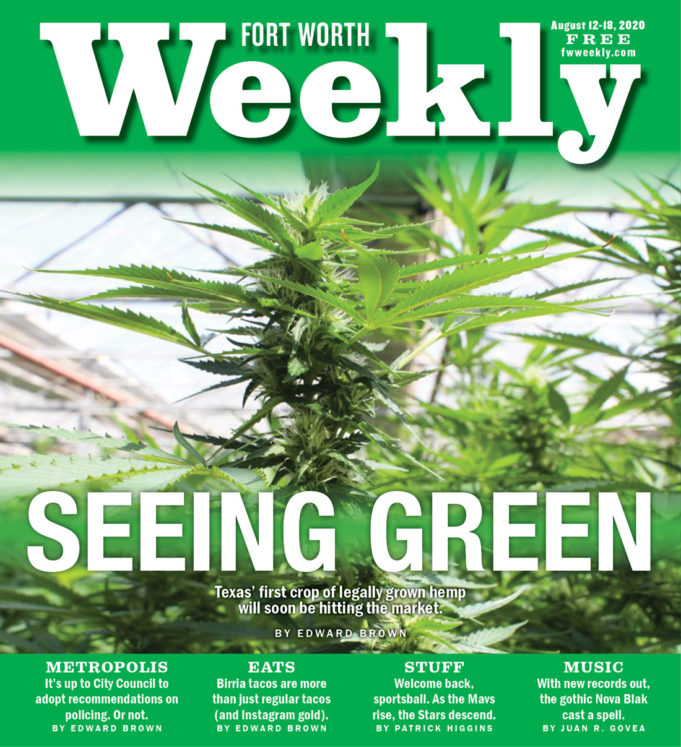

After a several-decade hiatus from the Texas agricultural landscape, hemp is back. Waxahachie-based Texas Botanics is one of a few dozen hemp farms to sprout up in North Texas over the past few months. The open-air facility consists of a central warehouse, large adjacent greenhouses, and offices. On a recent visit, a few dozen 2-foot-tall hemp plants labeled “mothers” sat near the entrance of one greenhouse. The moniker refers to the female plants’ role as the base for clones.

Leaning over the plant, grower Nathan Sherrer held one small branch and pointed to its base. If the branch were cut off and transplanted to a new cup of soil, he said, it would grow into a genetically identical copy of its “mother.”

The nursery model is where Texas Botanics owner Stephanie Brentlinger and Sherrer see Texas Botanics’ future. Texas farmers are now growing hemp for various purposes, including medicinal, industrial, and food-related ones. By working with partially grown cannabis clones, farmers can ensure that their crops have predictable levels of cannabinoids like CBD, Sherrer said. In an adjacent greenhouse, Sherrer pointed to a hemp flower, which looks surprisingly like the crystallized marijuana buds that adorn the covers of High Times.

Photo by Edward Brown

“There is a lot of potential there,” he said, referring to medical research on the benefits of cannabinoids. “You see research coming out on the diseases that cannabinoids can cure or treat. It’s something that can benefit everybody. To be a part of that feels good.”

Last March, the Texas Department of Agriculture (TDA) began accepting applications for licenses to grow hemp. That step allowed Texas to join 46 states and a global $4.7 billion industry. According to data provided by TDA, 27 licenses have been granted for hemp producers and handlers in Tarrant County. Several Fort Worth hemp growers have facilities in nearby cities like Azle, Grand Prairie, and Waxahachie.

In a 2019 story, the Weekly documented the events leading up to the passage of HB 1325 in May of that year. The bill created a legal framework for Texas farmers to grow hemp. The state bill followed on the heels of the federal 2018 Farm Bill that removed hemp with very low concentrations of THC from the Drug Enforcement Administration’s Controlled Substances Schedules. Marijuana and hemp are both members of the same plant species, Cannabis sativa L. While marijuana is grown and processed to produce THC (the psychoactive ingredient that induces a “high”), CBD, the target agent grown through hemp plants, does not produce intoxication but does alleviate a wide range of ailments and health conditions.

Sid Miller, Texas Commissioner of Agriculture, told us at the time that farmers would likely focus on medicinal extracts for 2020’s first hemp crop.

“Most people are just using the buds for CBD oil,” Miller said. “I don’t think people will be growing it for [food and fabrics] and so forth. We’ll get to that soon, though.”

The recent rollout of regulations governing the growth of hemp has created challenges for Brentlinger and Sherrer. TDA staff have been very helpful in answering questions, the business owners said, but fulfilling the bureaucratic steps of opening a hemp farm has pushed many Texas hemp farms into a growing season where temperatures are reaching the century mark, and questions remain about how well different hemp varieties will fare in Blackland Prairie soil and the North Texas climate.

If those hurdles weren’t enough, Brentlinger and Sherrer are dealing with the economic uncertainty brought by the COVID-19 pandemic. The business owner said her 2020 schedule was booked with weekly conventions and meetings that would have provided crucial networking opportunities. Even with those problems, the duo sees a bright future for a product that has long awaited the opportunity to bear the label Made in Texas.

*****

Photo by Edward Brown

Many Texas farmers have been heartened by a rapidly growing CBD market and predictions of future growth. In one 2019 prediction, analysts at the New York City investment bank Cowen & Co. estimated that CBD will be a $16 billion domestic market by 2025.

“There are a lot of folks who promote the idea that it is a crop you can get rich on,” Zachary Maxwell said.

The president of Arlington-based Texas Hemp Growers, a farmer association with around 200 members, said anyone who believes that hemp will offer easy money will likely be disappointed by the realities of growing a labor-intensive plant in an uncertain market.

“One challenge is the lack of buyers,” Maxwell said. “There are a lot of growers who jumped in and grew a lot of hemp [across the country]. Some of the figures out there are anywhere between 11% to 25% actually sold their crop. It’s not all rainbows and roses.”

Hemp prices are plunging due to a “grossly oversupplied” market, according to a recent article in Bloomberg News.

Brentlinger said the prices of CBD and other cannabinoids are hard to predict.

“There may be people who applied [for permits] who are sitting it out” this year due to uncertainty from COVID-19, she said. “It is hard to see who will be in the industry next year.”

Low hemp production in Texas this year could be a boon to growers who do manage to produce medical-grade hemp, especially given Texans’ penchant for supporting products made in the Lone Star State, she added.

Maxwell and his colleagues split their time educating members on the potential pitfalls of growing hemp and campaigning to connect wholesale buyers with Texas hemp farmers and processors.

Hemp seeds require a significant upfront investment for farmers. The average price of one hemp seed can range from 50 cents to $1, Maxwell said. “When you think about a grower who is growing an acre, that could require a minimum of $2,000. Those are big input costs.”

For a quality feminized seed (meaning it won’t produce psychoactive THC), a $1 seed could still be a profitable investment. Given the new climate and soil characteristics of Texas, Maxwell said buying seeds comes with uncertainties.

“All the genetics have come from out of state,” he said. “Colorado could be 7,000 to 9,000 feet higher than Texas. When you bring seeds down, you can run into phenotype issues. Your hemp plants don’t grow like you expected.”

Maxwell said some local farmers are seeing their hemp begin to flower weeks or even months ahead of schedule, which can drastically throw off a farmer’s timeline.

“Then there is the misunderstanding about this just being a plant-it-and-leave-it kind of crop,” he said. “That’s really not true. The problem is that farmers have to grow this plant like a marijuana plant. It has to be fed carefully and tended to. You can’t plant CBD hemp the same way that you plant industrial hemp. A lot of big agriculture farmers think they can seed hemp like cotton and wheat. They are in for a rude awakening. The farmers who will be the most successful are vegetable and small berry farmers and people who have a better understanding of the labor intensiveness of this plant.”

Photo by Edward Brown

What’s true for marijuana is just as true for hemp: The presence of even one male plant can spell disaster come harvest time. Isolating female marijuana plants promotes the production of THC and prevents seed production — a highly unprofitable biological imperative. Similarly, keeping male hemp plants away from females encourages the female plants to focus less on reproduction and more on producing CBD. Summer can be an unforgiving time for purging fields of male plants under a blistering sun.

“A lot of farmers underestimate the labor and cost estimates that go into growing a crop the market wants,” Maxwell said.

Farmers are up against more than Mother Nature. Texas’ first crop of hemp faces an uncertain market where retailers are hesitant to sign contracts with growers. That cycle, Maxwell said, then leaves farmers reluctant to invest in a large crop. Adding to many hemp farmers’ woes is the recent ban by the Texas Department of State Health Services (DSHS) on the retail sale and distribution of smokable hemp.

*****

After weeks of hearing testimony, DSHS recently adopted regulatory language that banned the manufacturing, processing, distribution, and retail sale of smokable hemp products. Texans are still allowed to light up hemp cigarettes or to grow hemp flowers (with a license) for their own use, but the new rules could effectively eliminate the retail sale of an important portion of the hemp market.

DSHS, which heard or read more than 1,700 public comments overwhelmingly against the ban, stated that the retail ban of smokable hemp is a logical extension of the prohibition against the manufacture of smokable hemp products as described in HB 1325, the original hemp farming bill.

“This will be devastating for retailers, some of which earn 50% to 80% of their sales from smokable hemp flower sales,” Maxwell said. “This is an assault by the state on Texas business owners. At a time when we are dealing with an economic crisis, this is not what the state of Texas should be doing.”

To protect the availability of pre-rolled hemp, CBD vape pens, and other forms of smokable hemp, Texas Hemp Growers recently raised more than $15,000 to support legal efforts aimed at what the growers call overreach by DSHS. The donations are now partly funding a lawsuit that was recently filed by Texas Hemp Legal Defense Fund, the lawyer-led plaintiffs, in Travis County. The suit aims to reverse DSHS’ ban on the retail sale of smokable help.

“When DSHS starts to enforce its rules, the attorneys are planning to file a briefing in court where they will request a temporary restraining order,” Maxwell said. “If we can get that, DSHS can’t enforce the ban while we are litigating in court. We’re confident the attorneys behind the Texas Hemp Legal Defense Fund will make a strong case in court so that this ban may be halted with a restraining order and possibly eliminated by a judge.”

Courtesy of Zachary Maxwell

Since the original HB 1325 did not explicitly restrict the distribution and retail sale of smokable hemp, Maxwell and his team believe that portion of DSHS’ restrictions can be struck down outright.

Crown Distributing, a North Texas-based manufacturer of smokable hemp goods, is a party to the suit and “seeks a declaration that the smokable bans in Texas are invalid and unconstitutional,” according to attorney Chelsie Spencer. According to a press release, Crown Distributing stands to lose $56.4 million dollars in revenue over the next five years if the ban is upheld.

The uncertainty over smokable Texas hemp highlights the interconnectedness between growers and retailers. Like many producers, farmers rely on retail stores to convert products into profits. Tim Blackwell, owner of Zen Alchemy Labs in Fort Worth, said CBD prices have fluctuated significantly over the past year.

“The popularity of CBD created a resurgence of farming,” Blackwell said. “We had an overabundance [of CBD] as a result. We have adjusted our prices to stay competitive, just like any business would.”

Blackwell and his team have started selling CBG, one of more than 100 cannabinoids native to the cannabis plant. The lesser-known cannabinoid is gaining popularity for its unique medicinal benefits, Blackwell said.

“The biggest benefits we’ve seen are for nausea, pain, and inflammation,” he said. “CBG is good for people with glaucoma, irritable bowel syndrome, and Crohn’s disease.”

While CBD has no direct soporific benefits, Blackwell said, many people who use Zen Alchemy Labs’ CBG products tell Blackwell that CBG is an effective sleep aid. Used in combination, CBD and CBG can help patients with sleep disorders or chronic pain find restful sleep, he added.

Ideally, Blackwell would like to see everything under the “cannabinoid umbrella” legalized for medical purposes.

“People are going to do it whether it’s legal or not,” he said. “We hope the state representatives will listen to [this community]. Law-abiding citizens are missing out on the benefits of THC, which can help with sleep and pain. A 50/50 dose of CBD and THC is one of the best pain managers available. You can have pain relief and still function. Anyone who is blending CBD and THC isn’t doing it to party. That’s for sure.”

Until marijuana is legalized across the country, important scientific research will be missing, he added. Blackwell sees the importance of winning the hearts and minds of those on the enforcement side of marijuana/hemp reform. His online store, which sells products at retailers throughout North Texas, offers discounts to police officers and military personnel.

“Police officers have a difficult job,” he said. “The things that they see can be classified as PTSD-inducing. THC will temporarily interact with your memories. For someone with PTSD, shutting out memories allows him to navigate the present and heal. CBD helps with the anxiety of that. Both sides of that plant can really help police officers, Blackwell said. “We don’t blame law enforcement [for how marijuana use has been criminalized]. We feel there is a lack of education.”

*****

Brentlinger and Sherrer are keeping their future growth strategies open. The ongoing economic downturn has afforded the duo time to test various hemp strains that would have otherwise sold as saplings. When the plants begin to flower, individual THC and CBD levels can be measured. A hemp strain that stays below the currently mandated .3% THC threshold in Kentucky may test hot in the Lone Star State’s climate, Sherrer said. Texas Botanics aims to be a source of knowledge in a state that was not afforded the option of growing hemp before last March.

“We are relying on other states [for data], not knowing how they will perform here,” Sherrer said. “There isn’t a good research program here in Texas.”

The current licensing fee to grow a strain of hemp is $500, according to the Texas Department of Agriculture’s website. Sherrer said that fee makes experimenting cost-prohibitive for all but the largest agriculture groups.

“We need to see the fees lighten up,” he continued. “The profits for hemp aren’t the same as [for medical or recreational] marijuana. These barriers may cause this industry to grow more slowly.”

Brentlinger said hemp and CBD have become mainstream, even among suburban white families who would have historically stayed away from anything that remotely resembled marijuana.

“Now people give hemp treats to their dogs,” she said. “We see a big future for Made in Texas hemp products.”

When asked what advice she would give to anyone interested in starting a hemp farm, Brentlinger advised that prospective hemp farmers “do their research.” She is quick to admit that she wouldn’t be able to enter the business without the help of Sherrer, who has extensive experience in horticulture.

“You want to have reputable partners,” she said, referring to suppliers, transporters, and other contract labor and business connections. “All the licensing and fees add up quickly if you aren’t careful. If you have never grown, I would not start with hemp. It is more appropriate for someone with a background in growing.”

Brentlinger remains bullish on hemp. Being one of Texas’ first hemp farms and nurseries has highlighted the heavy paperwork and fee structure that hemp farmers now face. While she is grateful to the prompt help that TDA staffers deliver, she hopes that future generations of hemp-minded entrepreneurs face fewer financial and bureaucratic obstacles.

“We want a level playing field with the other states,” she said. “If we can’t, then Texans will have to buy [hemp products] from other states.”

Even in the current economic and political climate, Maxwell sees a bright future for Texas’ smokable hemp industry. Hemp flowers are highly perishable by nature, he said, which means that retailers will need a steady local supply to support an industry that many rely upon for the pain-, stress-, and anxiety-relieving properties of CBD, CBG, and other cannabinoids that come from hemp flowers that now need to be carefully labeled to avoid DSHS’ new ban on smokable hemp. He also sees a bright future for large Texas farms that can garner contracts with local retailers.

The Texas hemp industry, he said, could learn a lot from the system of futures contracts that float staple crops like soy, corn, and wheat in the United States. The contracts are based on a predetermined price that a buyer promises the farmer at a specific time in the future. In his extensive communications with farmers and buyers, Maxwell said Texans seem largely aloof to the benefits of the well-established practice.

The Food and Drug Administration (FDA) has not approved CBD as a dietary supplement. There is growing public pressure for the FDA to greenlight the use of CBD as a supplement in mainstream food products, Maxwell said. Once large companies like Starbucks are free to offer CBD as readily as espresso shots, the hemp industry could reap the financial rewards.

In an email, FDA spokesperson Nathan Arnold said that the FDA recognizes that there is “substantial public interest in marketing and accessing CBD for a variety of products. We are working toward a goal of providing additional guidance and have made substantial progress. There are many questions to explore regarding the science, safety, effectiveness, and quality of products containing CBD, and we need to do our due diligence. Our first priority needs to be to protect the health and safety of Americans.”

The FDA, he continued, remains steadfast in its efforts to address consumer access in a way that protects public safety.

Maxwell said COVID-19 has created a huge setback for the Texas hemp industry, but hemp farmers, processors, and retailers should focus on growing the demand side of the hemp market.

“Right now, we don’t know where the buyers are at,” Maxwell said. “I’m not going to convince a farmer to grow 50 acres if I don’t know where to put it. Where is the farmer supposed to sell their crop? That is what it boils down to.”