So, jobless numbers are beginning to look a little better, housing foreclosures are leveling off, financial reforms are battling their way through Congress, and the government bailout, as painful as it was, seems to have helped stop the U.S. economy’s slide toward another Great Depression.

In all, the tide of bad economic news in this country looks like it’s beginning to recede –– or at least it was until an oil well in the Gulf of Mexico started spewing environmental disaster with no end in sight. But don’t put your waders away yet. One of the best-known –– and most controversial –– economists and futurists in this part of the country, with an internationally known record of on-target predictions, believes that another round of very dark days is around the corner, and for more than just the Gulf Coast.

In all, the tide of bad economic news in this country looks like it’s beginning to recede –– or at least it was until an oil well in the Gulf of Mexico started spewing environmental disaster with no end in sight. But don’t put your waders away yet. One of the best-known –– and most controversial –– economists and futurists in this part of the country, with an internationally known record of on-target predictions, believes that another round of very dark days is around the corner, and for more than just the Gulf Coast.

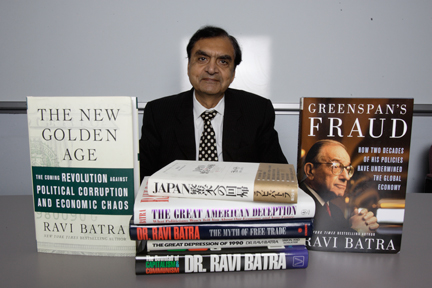

So what’s new about Southern Methodist University economics professor Ravi Batra predicting doom? That’s been his stock in trade since the 1980s, say his many detractors. True, he was one of the very few economists who correctly foresaw the deep economic troubles of the past few years and perhaps the only one to predict the rise of a charismatic leader like Barack Obama (not to mention earlier major predictions like the rise of Islam). But back in 2006, the Indian-born futurist and best-selling author also wrote that the election of someone like Obama might begin to usher in a new golden age of prosperity –– if such a leader brought with him some profound changes in American economic policies.

However, thus far, Batra believes, that mostly hasn’t happened. The massive infusions of tax money by Obama and his predecessor have managed to temporarily plug the leak in the economic bathtub, Batra concedes –– but at a terrible cost.

“The problem is, we’re stabilized at the bottom, and we’re not coming out of it,” he said. “If it takes $2 trillion or $3 trillion to produce this bit of recovery, then what happens if the government life-support slows down?”

Continuation of old policies and old ways of looking at the economy, he says, are going to lead America –– and thus the world –– to another crisis soon, probably later this year. If and when that happens, Batra says, there will be little capacity left for any more taxpayer bailouts –– and with unemployment still at near-record levels, the pain for the country could be much worse even than last time.

Many of Batra’s specific conclusions are also being reached by other economists: that the financial reforms being pushed through Congress aren’t enough, that the economic team brought on board by Obama represents just more of the same old stuff, and that too many of the big bankers and other architects of the last crisis are still in power. But for better or worse, few others look back as far as Batra does to explain the origins of the current problems. And even fewer leaders of Washington and Wall Street like the deep reforms –– indeed, the “throw the bastards out” sentiments –– that Batra espouses as a painful cure.

Almost no one likes his ideas –– excepts thousands of regular folks, business leaders, and admirers across a spectrum of professional disciplines, who may not agree with Batra on every point or on the depth of the doom he foresees but who believe that his theories ought to be included in the global debate now going on over how to fix the economy.

Ravi Batra “is a person singularly uninfluenced by the prevailing view … and I think that’s important,” said Gil Marmol, a former member of the executive committee at EDS and Perot Systems and also a former director at McKinsey and Company, a global management consulting firm. “When he challenged [then-Federal Reserve chairman Alan] Greenspan, it was when Greenspan was a deity –– not just a well-regarded person, but a deity.”

Batra “takes a very fundamental view of things and comes up with some pretty aggressive, unconventional recommendations, which, if taken seriously, I think would further the debate,” said Marmol, who is now an advisor to early-stage technology firms through his own Marmol & Associates.

The SMU economist “is one of the smartest people I have listened to or read,” said Paul Dimare, president of a national produce company with a Dallas-based subsidiary and other operations around the country, who believes wholeheartedly in some of Batra’s theories (on free trade, for instance), but rejects others (like raising the minimum wage). He calls Batra a socialist on some matters but nonetheless arranged for Batra to go to Miami to address a group of conservatives. “He’s brilliant. He should be on TV more. But he’s been excommunicated” by the economist community, Dimare said.

A new generation of economists may need to come to prominence before Batra’s ideas can be accepted, said another supporter, Ray Varghese, a North Texas high-tech business consultant and author who works to bring together brilliant thinkers from various disciplines and various countries for conferences to discuss topics in science, religion, and philosophy.

If that’s right, and if Batra’s right, that may be way too late to make the changes that Batra believes could pull our economy back from the brink — but just in time to help usher in the golden era that Batra figures lies beyond the current abyss.

Ravi Batra doesn’t care about Republicans or Democrats, which is good, since parts of his theories surely would distress leaders of both parties. He figures the American economy has been brought to its knees with help from a long list of political leaders, beginning with Ronald Reagan and his deregulating, tax-cutting (for the wealthy), and tax-raising (for everyone else) ways, and continuing through both Bushes, Bill Clinton’s major contribution of NAFTA, and Barack Obama’s ham-fisted handling of the bailout.

He sees a consistent reality running through all of those administrations: the continuation of policies that allow multinational corporations to corrupt politicians and pass laws and policies in their favor. Which leads, inexorably, to profiteering bankers who nearly brought down the country, an oil industry that is headed toward near-monopoly status, giant mergers that do nothing but reduce competition, and companies that grind down workers’ wages and benefits while simultaneously trying to get those same workers to buy more products.

In fact, you’d think Batra would almost be a favorite of the Tea Party set, were it not for his nagging sympathy with the worker and his call for significant increases in the minimum wage. After all, he’s predicting a voter revolution too.

Batra believes some bailout of the economy was needed in 2008 and 2009. But it was done so poorly and extravagantly –– by helping big banks instead of by helping consumers — that its tremendous cost may have weakened the U.S. economy for a long time to come, he says, and at a time when its strength is still needed to face new crises.

One of the most basic, unaddressed problems that Batra sees is the continually widening gap between supply and demand. As productivity rises, industries produce a larger and larger supply of products to sell. But because the wages of most workers in this country have been dropping rather than rising in recent years –– spurred on greatly by the outsourcing and free-trade trends that have sent so many jobs overseas — most Americans have less money to spend on those products.

One of the most basic, unaddressed problems that Batra sees is the continually widening gap between supply and demand. As productivity rises, industries produce a larger and larger supply of products to sell. But because the wages of most workers in this country have been dropping rather than rising in recent years –– spurred on greatly by the outsourcing and free-trade trends that have sent so many jobs overseas — most Americans have less money to spend on those products.

“Outsourcing is one of the worst trade policies we have right now,” he said. “We are creating jobs in other countries, and the money will be spent in other countries.” When the economy in this country stabilized after the 9/11 tragedies, he said, other parts of the financial system made a comeback, “but jobs did not. Why? Outsourcing.”

So the problem continues to get worse. And, he said, the downward pressure on wages (and therefore, on demand) is happening worldwide, not just in this country.

“There are incredible imbalances all over the world, and no one wants to reward the workers,” he said. “I don’t know if that’s conservative or liberal, but it’s fair.”

In the U.S. from about 1981 to 2007, Batra said, the government was able to plug this gap by creating more and more government debt, and by encouraging consumer debt, thereby adding enough boost to the economy to artificially keep demand close to the level of supply.

But now, he said, “on the consumer side, that is no longer possible.” If the gap continues to grow, he said, “the only avenue now is to create more and more government debt.” The resulting expansion in the national debt in this country, he said, “is a fundamental problem that will eat our economy alive.”

None of that supply-and-demand problem was fixed by the bailout, which is a major reason for Batra’s pessimism about the near future. He also believes that the big banks in this country are continuing down the road of irresponsible profiteering, including by speculating in the oil market in such a way that they are propping up oil prices when they ought to be allowed to fall.

In fact, he believes increases in oil prices later this year will help squelch the recovery and set us up for the second leg of the recession, “and it will be worse than what we had in ’08-’09.”

It’s not hard to divine why Batra believes the second round will be more painful.

“When the patient is already sick, any deterioration will feel much worse,” he said.

Officially, unemployment nationwide is hovering around 10 percent. Unofficially, the economist said, the figure is more like 16 to 17 percent, taking into account the folks who’ve given up and stopped looking for work and the percentage of jobs that are temporary. Adding even another 1 or 2 percent to that rate, he said, will begin to feel like despair for many of those who are out of work. He thinks total unemployment will rise as high as 18 million people, about 3 million more than the current figure.

Batra believes there are many things to be done, including financial reforms, measures to penalize companies for outsourcing, and measures to stop oil profiteering. But he doesn’t expect to see many of those things happen, or much economic improvement, until the election cycle of 2012. Corporations will of course oppose many of his suggested measures, but “with 18 million people unemployed, nothing should be a tough sell,” he said. At that point, he expects public outrage to be a real factor in bringing about a housecleaning of policies and politicians who favor the rich and powerful over the general citizenry.

Over the years, Batra has had his share of the national limelight, even though plenty of it has come with asterisks, backhanded compliments, and grudging acknowledgment of the accuracy of so many of his major predictions. Several of his books have reached best-seller or “cult classic” status. He’s received national and international awards. He was a major critic of Greenspan long before the Fed chairman fell from grace nationally. An article in SmartMoney magazine last year acknowledged Batra as one of only a small handful of experts who, two years before, had predicted the economic crisis but been “dismissed as doomsayers or crackpots.”

But getting most economists to comment on Batra and his theories these days is like asking an elephant to discourse on a pesky fly: They don’t have to accord him notice, and so they don’t.

“I don’t want to talk about Ravi Batra. I haven’t seen him for years,” said a former global strategist for Morgan Stanley, who once had applauded Batra’s forecasting record and his “formidable academic reputation.”

It’s all par for the course for Batra, who has seen and heard it all many times before.

It’s not that many of his conclusions are so different than those of his colleagues, though the theoretical underpinnings of his predictions are far different than those of most others.

Jeremy Grantham, whom SmartMoney called the “king of the contrarians,” noted in the 2009 article that Obama had brought in “tired old retreads from the financial area that notoriously didn’t blow a whistle over the last few years” to run his economic policy.

Nouriel Roubini, quoted in that same article as someone who also correctly predicted the recent economic disasters, said more recently in The New York Times that the crisis was caused not by short-term problems but by deeper problems that had been building for years. Roubini, who teaches economics at New York University, called for wholesale reform of the financial system and said that the tax cuts and increased borrowing abroad were dangerous trends that could damage the country seriously in the long run.

Nouriel Roubini, quoted in that same article as someone who also correctly predicted the recent economic disasters, said more recently in The New York Times that the crisis was caused not by short-term problems but by deeper problems that had been building for years. Roubini, who teaches economics at New York University, called for wholesale reform of the financial system and said that the tax cuts and increased borrowing abroad were dangerous trends that could damage the country seriously in the long run.

Regardless of whether Batra is getting warm applause or the cold shoulder from the economic establishment, however, his message seems to be finding traction among a growing group of business leaders and others here in the hinterlands. For all of their exotic underpinnings and unpleasant conclusions, Batra’s view of economics –– supply and demand, debt, loss of jobs –– seems practical to many.

Kevin Hanks, an independent consultant who provides strategic advice and CFO services to companies, invited Batra, at the behest of another club member, to speak to the Harvard Business School Club of Dallas. He was a little worried by what he read on the internet about the economist, Hanks said, but Batra turned out to be a provocative and self-deprecating speaker who presented credible ideas and gave the group plenty of things to think about. Batra’s point about the danger of growing public debt was one that particularly struck home with Hanks.

It’s the kind of reaction that Batra’s friends say he usually gets when he speaks to business groups –– not opposition, despite the radical nature of some of his suggestions, but thoughtful questions. But for the most part, neither they nor Batra himself expect the Obama administration or the economics establishment to change their tune toward him any time soon.

“Let’s be realistic,” said Gil Marmol. Even if White House economists liked some of Batra’s ideas, he said, it probably wouldn’t be “politically feasible or desirable” to publicly endorse them. So much of Batra’s theory, he said, is “outside the realm of political consensus. The White House cannot change the political consensus … fundamentally.”

Batra said he gets many calls and messages from listeners to broadcasts in which he is interviewed and from readers, asking, “Why are you not working for the Obama administration?” The administration has its own experts, he said, who figure that, with the stock market regaining ground and job losses slowed, they must be on the right track.

“But what about all the people who are still jobless?” he asked. “We owe it to them to do something.” Instead, he said, economic policy seems to be mostly business as usual.

Roy Varghese said that even if another deep recession hits, he doubts much will change in official economic policy anytime soon. “Even then, they’ll just see it in the light of [their own theories]” and assume they just need to make some modifications –– to apply a few patches, he said.

Batra places his faith in the ballot box, figuring that if things get truly terrible, voters will throw the bums out and institute what he calls “economic democracy.”

So — who says he’s pessimistic?